INVEST YOUR TAX REFUND IN YOUR CHILD’S FUTURE.

You work hard to put extra money aside for your child’s college education, so it’s great when a little extra money finds you. To make the most of your tax refund:

- If you are filing online or by paper, it’s easy to have your tax return deposited into your IDeal account just like you would into a traditional bank account. Simply include IDeal as the refund direct deposit destination when prompted by the online service, or on line 56 of Form 40, or on line 77 of Form 43:

- IDeal Routing Number: ABA Number 011001234 (Mellon Bank)

- IDeal Account Number: 541 + 11-digit account number

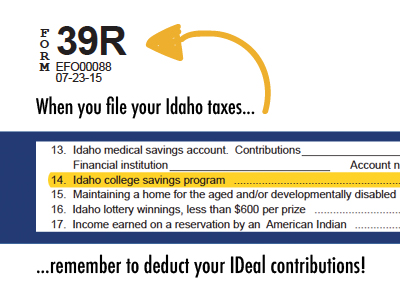

- IDeal can help you potentially increase your refund. Deduct your IDeal 529 contributions on Form 39, Line 14 of your tax returns.

- Idaho taxpayers can qualify for up to a $12,000 state tax deduction (up to $6,000 for individuals), when they contribute to any IDeal 529 account.1

Use your tax refund to open or add to an IDeal 529 account.

Every contribution, including your tax refund, can potentially grow tax-deferred.

So contribute to an IDeal 529 account as early as possible, when it has more time to grow year after year – without the impact of state and federal taxes.

Then, at college time, make tax-free withdrawals to pay for qualified expenses, like tuition, room and board, books, computers, and more.2

2Earnings on non-qualified withdrawals are subject to federal income tax and may be subject to a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.