Planning ahead: it's never too early, or too late

One of the best college savings strategies is simple: start. Not sure how? At IDeal, we're happy to help. We visit with families all the time, and find that having conversations about saving versus borrowing, myths about 529 plans, and setting goals can help clear up a lot of confusion.

The value of planning is measured

in more than dollars and cents.

Children with college savings accounts are seven times more likely to attend college than kids who had no such savings.1

The truth is, even small contributions to an IDeal account can add up. For example, just once a month, invest the money you would spend on a night out with the family. Or skip a few morning coffees every week. Studies have shown that regular investments can add up to a significant college nest egg over time.2

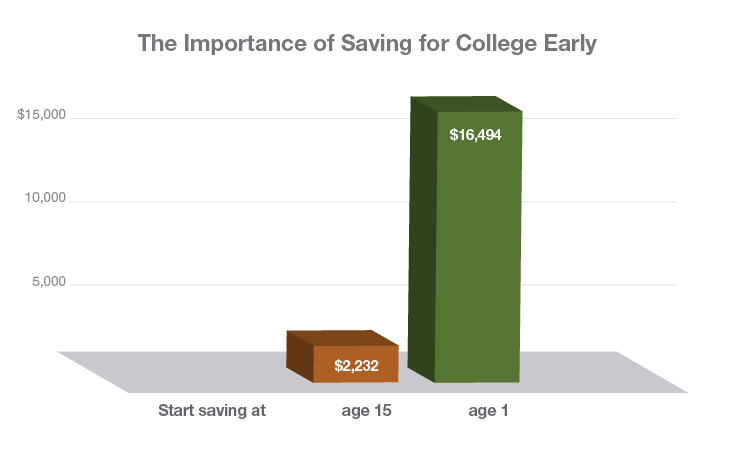

As you can see in this hypothetical chart, if an account owner began to save $50 a month when a child was 1 year old (with an initial contribution of $250), a 529 college savings plan could potentially have an account worth $16,677 by the time the child was age 18.

Starting an account later in a child's life (say, age 15) could still result in tax-free assets of more than $2,000.3

Keeping pace with college costs.*

What will be the price tag of college? A lot depends on the type of post-secondary school your student will be attending. Community college? 4-year public college (in-state or out-of-state)? 4-year private university? Graduate school?

As you can see in the following hypothetical charts, college tuition and fees in Idaho and around the nation is likely to keep rising. The sooner you start saving, the easier it can be to make the dream of a college education a reality.