In their own words:

Stories from Idaho families.

Since 2001, we’ve helped over 60,000 Idaho families save for higher education. In fact, many of the children whose families opened an IDeal 529 in the last 20 years have already graduated from college and are beginning their careers.

How do we know? We asked. We asked thousands of Idaho families who have benefitted from an IDeal 529 to tell us about their experiences. Read some of their stories.

Congratulations to IDeal's, 20th Anniversary "Tell Us Your IDeal Story Contest" Winners

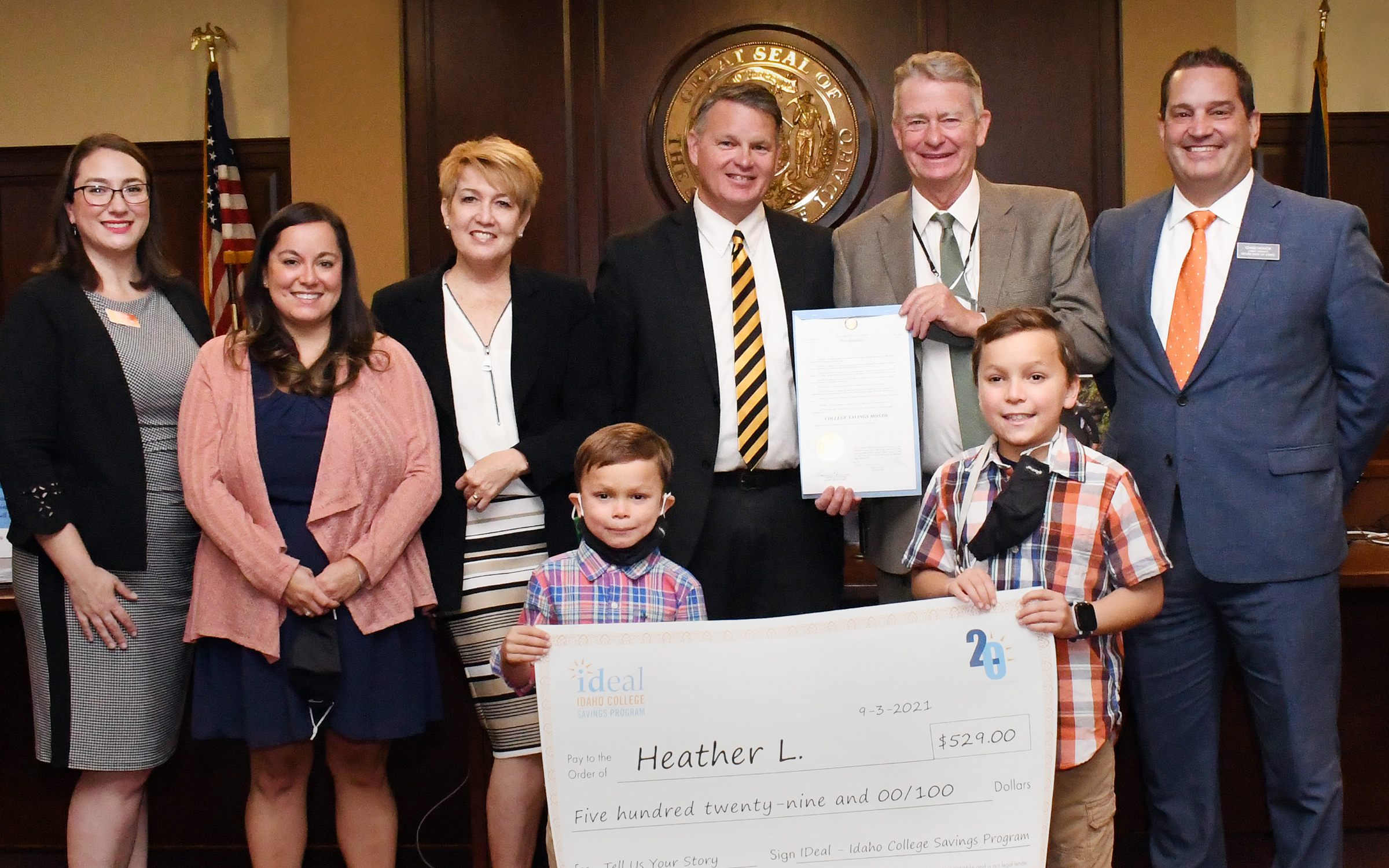

Heather Lucero- Boise, ID

Heather’s story was randomly drawn from all the contest entries to receive a $529 IDeal contribution to an IDeal account. She plans to split it between her two children.

From left to right: HannaLore Hein, Idaho State Historian; Heather Lucero, Tell Us Your Story $529 winner; Julie Ellsworth, Idaho State Treasurer; Benjamin D., son of Heather Lucero; Brian Kane, Chief Deputy Attorney General; Brad Little, Idaho Governor; Bradley D., son of Heather Lucero; Chad Houck, Deputy Secretary of State

"I have two young sons that will attend college about a decade from now. Their dream is to NOT worry about how to pay for college. Rather than worrying about juggling a job on top of school or going into debt to get a quality education, let them worry about getting good grades, meeting new friends, creating memories and learning how to transition into adulthood. Their career dreams change week over week. My oldest son, 8 years old, wants to be a performer (singing and dancing), a geologist, or an interior designer. My youngest son, 6 years old, wants to be an engineer, a police officer, or a garbage truck driver. My dream is that they can focus on becoming who they are meant to be, whatever that ends up to be. I want them to be happy and fulfilled, not stressed with the journey ahead of them. An IDeal 529 account can make that possible.

- Heather Lucero

Raymond Mikus- Boise, ID

Raymond’s story was randomly drawn from all the contest entries to receive a $529 IDeal contribution to an IDeal account.

From left to right: Heather Lucero, Tell Us Your Story $529 winner; Benjamin D., son of Heather Lucero; Bradley D., son of Heather Lucero; Raymond Mikus, Tell Us Your Story $529 winner; Nick Thiros, IDeal Field Representative; Goldie Bishop – IDeal Project Coordinator; Laura Lantz, Executive Director of Idaho Society of CPAs; Christine Stoll, IDeal Executive Director; HannaLore Hein, Idaho State Historian; Julie Ellsworth, Idaho State Treasurer; Chad Houck, Deputy Secretary of State; Brian Kane, Chief Deputy Attorney General; Norm Beckert, 20 Year IDeal Saver; Angela Phillips, Idaho Financial Literacy Coalition President; Kristy Massie, Idaho Financial Literacy Coalition Treasurer; Elleyna B., daughter of Goldie Bishop

"My wife and I are saving so our child can go to college if she wants and be the first from both sides of her family to graduate college.”

- Raymond Mikus

See Official Rules for details.

Alexandra Lundgren has been helping Idahoans save, invest and plan for retirement for more than 23 years. She’s confident in her ability to spot a savvy, sound investment when she sees one.

Alexandra Lundgren has been helping Idahoans save, invest and plan for retirement for more than 23 years. She’s confident in her ability to spot a savvy, sound investment when she sees one.

This experience is why she encourages clients that have post-secondary education goals for themselves or their children to open an IDeal 529 account and begin saving as early as possible. It’s the reason she and her husband, Joe, did the same 20 years ago when IDeal, Idaho’s state sponsored 529 college savings program, was launched and began helping families prepare for their children’s higher education dreams.

In 2021, IDeal is marking its 20th anniversary, and as part of the celebration is spotlighting some of the pioneering parents who recognized the value of the program, its investment strengths, the lack of broker fees and the tax benefits.

“We recommend IDeal accounts to clients all the time,” said Lundgren, who works at Tree City Advisors in Boise. “And getting started is not a difficult process at all. I can’t tell you how many clients I’ve helped here in the office while they simply go online to quickly open accounts and begin investing in the future.”

Lundgren and her husband, who works for Micron Technology Inc., have two children – Alice, 27, and Brandt, 22 – both of whom have enjoyed the benefits of IDeal accounts.

“We opened one for Alice as soon as we knew they were available,” said Lundgren, who added that she was using other tools to save for Alice’s education before 529s were approved in Idaho.

Growing up as one of six siblings, Lundgren said her parents didn’t have the resources to put money away for her college expenses. As a parent, Lundgren realized the cost of tuition, books, room and board were only going to increase over time.

“We really wanted to be able to help the kids if they chose to go on to college or a technical program,” she said. “We didn’t want cost to be a deterrent for them. It was really all about making sure money wasn’t a reason they don’t pursue education after high school.”

Alice enrolled in the College of Western Idaho (CWI) after high school, completed a program in Information Technology and is now working in the IT arena for a private company in San Francisco. Brandt is also enrolled at CWI.

In addition, Lundgren has used the 529 account to pay for her own educational growth, specifically sign language classes at Boise State University. Flexibility in the IDeal program allows for account owners to use their investment to pay for adult tuition, qualified expenses or pay down their own student debt.

“As parents, it was really comforting to know we were saving for higher education,” she said. “We are pretty anti-debt in our household. If we had not have saved, I feel like the cost of school and the potential of be being in debt may have been a deterrent for our kids. We always told them, ‘Don’t skip going to college because of costs, because of saving and 529s, the money is here for you.’”

Shortly after the birth of their first child, Chet and Jennifer Butikofer established two priorities essential to their newborn son’s future: Take the steps necessary to ensure he would one day be able to obtain a quality education after high school and help him avoid the burden of taking out student loans to pay for it.

Shortly after the birth of their first child, Chet and Jennifer Butikofer established two priorities essential to their newborn son’s future: Take the steps necessary to ensure he would one day be able to obtain a quality education after high school and help him avoid the burden of taking out student loans to pay for it.

A little bit of Internet research led Chet to a freshly minted savings plan called IDeal – Idaho’s homegrown 529 college savings program. For Chet and Jennifer, IDeal had the investment framework for saving and growing their assets that suited their needs and goals. A series of tax benefits built into IDeal made the program even more enticing.

“We were ready to go the moment our son Blake was born, and we just started routinely trickling money into his IDeal account,” Chet said. “We really wanted our kids to be able to get a good education to advance themselves and to leave school without a massive load of debt on their shoulders.”

Three more children followed over the next seven years. With each child came a new 529 account, one each for Julia, Luke and Noah. This fall, Blake, 20, who spent two years after high school on a mission, and Julia will both enroll at Brigham Young University using savings from their accounts to begin paying for tuition, books, housing and other expenses.

“We’re so excited we put money away for their education, especially with the way it turned out with Blake and Julia enrolling at the same time,” Chet said. “It makes us realize the power of saving when you start adding up all the costs, because that’s when the reality sets in that this is going to be more expensive than what we initially thought.”

Over the last two decades, Chet and Jennifer used the automatic deduction feature of IDeal to help reach their savings goals. Chet acknowledges there were moments when they paused the automatic deductions when the family budget tightened. But after each break, the couple resumed saving and growing the 529 accounts.

Saving and investing is a common theme in the Butikofer home, and Chet says his children understand the power of letting money grow over time. IDeal’s pool of assets is managed by experienced financial advisors and gives account owners different risk options for their investment.

Chet also praises the tax advantages inherent in IDeal, which provides account owners a state income tax reduction of up to $6,000 per account, or $12,000 if filing jointly, tax-deferred earnings and tax-free withdrawals for qualified expenses.

“To me, there are limited programs out there for tax-free growth,” Chet said. “It’s one of those things that for me is hard to ignore. I encourage people to take advantage of a program like IDeal by starting their saving as soon as possible, even if it’s a small monthly amount. Keep trickling it in and let it ride.”

When Mike Adolf was a young boy, his grandfather passed away and left him $500 and specific instructions that it be used one day specifically to pay for higher education. He remembers feeling like $500 was a lot of money at his age. But the gift turned out to be a driving force that motivated him to pursue a college degree.

When Mike Adolf was a young boy, his grandfather passed away and left him $500 and specific instructions that it be used one day specifically to pay for higher education. He remembers feeling like $500 was a lot of money at his age. But the gift turned out to be a driving force that motivated him to pursue a college degree.

His wife, Stephanie, was also gifted with a financial investment at a young age when her great-aunt passed away and left seed money for attending college. When the couple had their first two children, they knew they wanted to pass down the message of encouragement and confidence that they were fortunate enough to receive.

Mike and Stephanie were also cognizant of the financial realities of sending their kids to college. They watched as the cost of tuition, books and other expenses began to rise, which set in motion an investigation into the opportunities to save for their children’s future education.

“We looked at the different options available and we didn’t see a good way to save for education. Then, we saw a news story about the IDeal program starting in Idaho. Once it became available, we created accounts for our two kids,” Mike said. As other children came along, they opened accounts for those children also.

The Adolf family now has four kids and three of them are currently using their IDeal accounts for college costs. Their oldest son is studying Civil Engineering at BYU-Idaho and their daughter is studying Biodiversity and Conservation at BYU-Provo. Another son will be starting college this fall. Mike says that their daughter was very motivated by her IDeal account to pursue higher education.

“When our daughter was in high school, she was very concerned about the financial cost of college. We showed her that we were going to be able to afford the expenses with her IDeal savings, and it helped both of our oldest kids feel more comfortable enrolling in higher education.”

Outside of the financial security and motivational aspects of IDeal, the Adolfs appreciate just how easy it is to use the program. The couple makes direct deposits into their children’s accounts, in order to earmark that money only for education. They also like that the 529 accounts aren’t limited to being used exclusively for college. For example, account funds can also be applied to trade schools or other types of post-secondary education.

Mike is planning to encourage his kids to open accounts for their kids and he often recommends the IDeal program to friends and family.

“Starting early is the main thing,” he says. “Put away whatever you can afford. It’s very convenient to make direct deposits and your savings will build up over time.”

Fortunately, the Adolfs’ two younger children aren’t as concerned about being able to afford higher education after seeing their brother and sister go to school with the financial means to cover much of the costs. Mike and Stephanie hope that all of their kids will be able to leave college financially comfortable and start their careers without the sizeable student debt payments facing so many college graduates these days. Thanks to IDeal, they’re able to tell their kids that when it comes to paying for post-secondary education “there’s nothing to be worried about.”

Norm and Patricia Beckert have nine grandkids sprinkled across the country from Texas to Philadelphia to Chicago. Three of them are college graduates, including a granddaughter with a graduate degree, and six are on the path to higher education thanks to an insightful investment by Norm and Patricia twenty years ago.

Norm and Patricia Beckert have nine grandkids sprinkled across the country from Texas to Philadelphia to Chicago. Three of them are college graduates, including a granddaughter with a graduate degree, and six are on the path to higher education thanks to an insightful investment by Norm and Patricia twenty years ago.

Idaho began the IDeal 529 College Savings Program around twenty years ago, and the Beckert’s wasted no time in starting seven accounts to fund their grandkids’ future education. When the two youngest grandchildren were born, the Beckert’s opened accounts for them, too.

Norm and Patricia liked that the IDeal Program was easy to understand; they could invest as much money as they felt comfortable with. They also recognized that the IDeal program was a smart investment strategy thanks to the tax benefits tied to their contributions.

Their first two grandkids, Kaitlyn and Kyle, graduated from Texas Tech University and Louisiana State University, respectively. They only needed to borrow a minimal amount through student loans since they used the savings in their IDeal accounts for much of their college expenses. Both have already paid off their student loan debt. Kaitlyn was also able to go on to graduate school and finish with no student loans. The third grandchild, Kevin, is also leaving school without any student loan debt.

Norm says, “My wife and I figured all the grandkids were going to go to college and IDeal was a way that we could contribute to that and help offset some of the costs.”

In addition, the decision to open and invest in the 529 accounts improved the household financial stability of the parents. The Beckert’s frequently encourage their grandkids to make responsible financial decisions, and when the time is right, Norm said he will urge each of them to open 529s for their own kids one day.

For the Beckert’s, being smart with money, saving and investing is a critical message for the young people in their lives. In fact, one Christmas, they bought “smart money” books for each of their grandchildren, hoping they would absorb the risks and pitfalls of borrowing money. “I really just wanted them to understand the need to consider various alternatives for saving for the future,” he said.

Paul Fritz and his wife Margie knew early they wanted their children to pursue education after high school. The couple also wanted their children to have funds saved when the time came to spend it on tuition, books and living expenses.

Paul Fritz and his wife Margie knew early they wanted their children to pursue education after high school. The couple also wanted their children to have funds saved when the time came to spend it on tuition, books and living expenses.

Paul and Margie were so intent they began saving the year their first child was born, and even before the formation of IDeal, Idaho’s own state sponsored 529 College Savings Program.

“We knew we wanted our kids to go to college before they were born,” Paul said. “We had college savings accounts administered by a national program at that time because we knew it would be quite a burden down the road as far as costs.”

Shortly after the launch of IDeal in 2001, Paul opened 529 accounts, among the first 800 or so college savings accounts opened during IDeal’s inaugural year.

Over time, the couple’s monthly savings, combined with earnings from IDeal’s managed assets, grew enough to cover the costs of undergraduate degrees for Jacob and Morgan. Jacob, 22, recently graduated from the University of Utah with an accounting degree and is now pursuing his Master’s in Accounting.

Morgan, 21, is also studying accounting at the University of Utah and plans to graduate in December 2021. She also plans on earning a Master’s and chase her dream of becoming a Certified Public Accountant.

“Truthfully, I think it all worked out perfectly,” Paul said. “We grew those account balances up until they went to college. The out-of-state costs were a little more than we anticipated, but we had enough saved for their undergraduate costs.”

In addition to the ability to save and use financial markets to grow account balances, Paul, a former accountant, credits the built-in tax advantages for making IDeal such a bargain and value for Idahoans. Under state tax law, account owners can claim a tax deduction of up to $6,000 individually or $12,000 if filing jointly. “That’s something we really tried to leverage every year, both to build on the balances but also to save on our annual tax burden,” Paul said.

But for Paul and Margie, the biggest dividend from their investment in IDeal may have been the lasting impact it has had on their children.

“As they got older, especially as they got in college and saw how we saved, I think they came to better understand how important that was, especially in seeing what so many of their friends were up against in terms of costs,” Paul said. “I believe it helped them graduate sooner and move on without significant debt. It has given them a strong first step into their careers and lives.”

Congratulations to IDeal's, "Tell Us Your IDeal Story Contest" Winner

Kimberly Salisbury- Moscow, ID

Kim’s story was randomly drawn from all of the contest entries to receive a $1,500 IDeal contribution to an IDeal account. She plans to split it between her two children.

"Education is very important for both my husband and I. I graduated with a Bachelors and Masters degree from the University of Idaho, and my husband graduated from Northwest Nazarene University. Our educations allowed us the chance to pursue dreams that we would not have been able to otherwise. We have two boys, 9 and 10 years old and have been saving for about 3 years for them through IDeal. It is a great way to build up funds for them to use for college, and through payroll deduction it's easy for us to make biweekly contributions. We're very excited to take withdrawals to fund their future educations!"

"Education is very important for both my husband and I. I graduated with a Bachelors and Masters degree from the University of Idaho, and my husband graduated from Northwest Nazarene University. Our educations allowed us the chance to pursue dreams that we would not have been able to otherwise. We have two boys, 9 and 10 years old and have been saving for about 3 years for them through IDeal. It is a great way to build up funds for them to use for college, and through payroll deduction it's easy for us to make biweekly contributions. We're very excited to take withdrawals to fund their future educations!"

-Kimberly Salisbury

See Official Rules for details.

"When we found out we were having a baby, we made some decisions about our lives," Andrew said. "We decided that higher education was extremely important and that we would do whatever was necessary to make sure our son could get an education."

"When we found out we were having a baby, we made some decisions about our lives," Andrew said. "We decided that higher education was extremely important and that we would do whatever was necessary to make sure our son could get an education."

The Starks are in the majority of the more than 15,000 Idahoans with 529 plans — the No. 1 reason for starting an account is the birth of a child.

"We decided Eli would have every opportunity possible to attend college because we are living proof of the difference higher education makes in someone's life," Andrew said.

Monze is a first generation college graduate. She was born in Mexico and her parents moved the family to Idaho so her father could work in the dairy industry while her mother worked in the fields, cleaned houses and did various other jobs to help support their four daughters.

Monze's parents encouraged their eldest to go to college and live the American dream, but they didn’t have the ability to help financially. Monze earned scholarships but she also incurred student loan debt. She now works at the University of Idaho advising multicultural students on how to digest the costs of continuing their education. She helped her husband and sisters complete college and she’s well aware of the costs. Andrew is a communication specialist at UI. "Because of my background, it was a no-brainer for us to figure out how our child would not have to worry about finances," she said. "I promised myself he'd have a better life than what I had because that's what my family wanted for me and that's what I want for my child."

-Andrew & Monze Stark

Teresa Noble knows first-hand of the benefits of long-time investments in Idaho’s 529 Plan. She started plans for her two daughters 15 years ago. “I am so thankful because it was a very wise investment for my family,” she said.

Teresa Noble knows first-hand of the benefits of long-time investments in Idaho’s 529 Plan. She started plans for her two daughters 15 years ago. “I am so thankful because it was a very wise investment for my family,” she said.

Teresa Noble was able to pay full tuition for her daughters to graduate from college thanks to Idaho’s 529 College Savings Plan.

Both of her daughters earned undergraduate degrees without debt. Her older daughter Sydney is continuing to invest in her 529 Plan as she purses a master’s degree.

“Because we saved this money, they were able to do a lot of things in college they would not have been able to do, things they loved, such as jobs in social justice work,” Noble said. “They weren’t so strapped for cash.”

-Teresa Noble

Like any grandparent, Tony Billiard, of Buhl, loves spending time with his four grandchildren. On a recent camping trip with the two eldest, talk turned to plans for the future. He asked his granddaughter, who’s ten years old, what she was interested in doing after high school. She replied that she wasn’t sure, and that her mother—Tony’s daughter—seemed to be very anxious about the thought of trying to help pay for college. "I don’t know if I’ve ever told you," he replied, "but I’ve got a college savings account set up for you and your siblings." Billiard notes that he didn’t originally intend to tell his granddaughter about the IDeal—Idaho 529 College Savings Program account he had opened for her, but in that moment he wanted to relieve her worries and let her know that when she graduated, it would be possible for her to go on to college.

On that same camping trip, Billiard’s granddaughter did eventually share her ambitions with him. "She said she wants to be a singer or an actress because she loves to sing and dance. This summer my daughter sent her to theater camp at CSI, and she’s already looking forward to doing the theater camp again next summer."

Billiard remembers what it was like being a parent with young children. "We had plans to get a savings account started for our kids, but with the other commitments you have, it’s hard to save. Consequently, when our three kids graduated high school, we had very little money set aside to help them. I felt terrible about it." Years later, in 2007, Billiard’s employer distributed information about IDeal, Idaho's 529 College Savings Program. Billiard thought of his daughter, now grown and a single mother, and his newborn granddaughter, and decided to seize the opportunity to start saving. "The opportunity presented itself and I was in a financial position where I could put some money away every month…it was one of those things that I don't even know I would have thought about otherwise." When more grandchildren came along, he opened and started contributing to IDeal accounts for each of them.

For Tony, the motivation to save is rooted in his experience watching his wife and daughter—both of whom attended college later in life—work to balance their schooling with their family responsibilities. "I have a two-year, VoTech program degree, and I’ve got a really good job. But my wife didn't have a degree until our kids got older. She went back to school to get a teaching degree and eventually got her master’s degree. It was amazing to see what she did balancing a family with her studies." Likewise, Billiard's daughter had to go back to school later on, and she too now has a teaching degree and a master's. When it comes to his granddaughter, "I have dreams that she can do something like that too, but after high school rather than waiting until she has a family."

When asked why he saves with IDeal, Tony says, "To be honest, apart from just a savings account, I don't know what other options are available to save for college. But the fact that it's an Idaho program, that speaks a lot to me. It’s right here, it's in our state, it's available to anybody for a relatively small fee."

Billiard emphasizes that the plan helps with peace-of-mind about his grandchildren’s futures. "I know it's there, I know it’s building, but I’m not concerned about it. I know in the end she’s going to have a chunk of money to help further her education."

-Tony Billiard

"Every little bit counts. My girls understand that there's money being put away for them for school every month. They have said no to toys they've seen at a store or at a friend’s house because they rather have that money saved for them for college.

"Every little bit counts. My girls understand that there's money being put away for them for school every month. They have said no to toys they've seen at a store or at a friend’s house because they rather have that money saved for them for college.

There's been so much awareness about college in the future for them due to actively saving for college!"

-Joni Shepherson

"As a teen mother, I have learned that things do not always go according to plan. Whether it be the plan of going to the park then unexpectedly having to change outfits because of spit-up, or having to add on bulk level of classes at the college in hopes of graduating with a degree that will give you a boost in life. In the sporadic moments of my life, I have learned how to manage my time better, along with my money. While college had never been a laid out plan for my future, my unexpected little one made me realize I needed a backup plan in the form of a college degree. However, while this may have been the perfect safety net, it is easier said than done.

"As a teen mother, I have learned that things do not always go according to plan. Whether it be the plan of going to the park then unexpectedly having to change outfits because of spit-up, or having to add on bulk level of classes at the college in hopes of graduating with a degree that will give you a boost in life. In the sporadic moments of my life, I have learned how to manage my time better, along with my money. While college had never been a laid out plan for my future, my unexpected little one made me realize I needed a backup plan in the form of a college degree. However, while this may have been the perfect safety net, it is easier said than done.

Luckily for me, my high school offers a program that allows students to obtain college credits while taking their regular classes through the high school. In this dual credit program, we were given two hundred dollars to go towards three credits, but as a teen mother trying to establish a future for myself and child, I took way more than the three credits that the school pays for. The amount left over was over eight hundred. For many students taking over ten credits, this was a huge burden, but thanks to my IDeal college savings plan I was able to pay the amount without any financial stress on my family and me. This was beneficial to us since we had enough on our plates as it was.

The closer I move towards my senior year the more I find myself looking into colleges and becoming discouraged with the numbers that I am seeing. My dream is to attend a four-year college, but that is quite expensive for someone in my situation. Knowing that I have a saving account that I can contribute to as I grow older makes the numbers seem less scary, and I find myself less discouraged with the amount colleges expect us to pay.

Thanks to IDeal the future doesn’t look as shaky as it did before. I know that as I go forward into my life, I will have an account waiting for me to continue my education and not only provide me with the money needed to achieve my dreams, but also to provide my family and I with the support we need throughout our educational life. Being a young mother in this crazy world we live in is beginning to be more of a blessing than a curse with every step I take towards getting my business degree. I look forward to attending a four-year college instead of stopping at a two year, and even more than that; I look forward to proving to myself that I can do anything that I set my mind to."

-Miranda Satterwhite

Rob Stark has worked for the United States Postal Service for 25 years. His wife Vicki retired from the Postal Service last year. While Rob is thankful for the stability and salary that allowed him and his wife to provide for their four children, he wouldn’t describe postal work as his "calling." When the IDeal —Idaho College Savings Program, launched in 2001, Rob and Vicki jumped on the chance to provide their kids with an education that would let them do more than pay the bills. They expected that, with college degrees, their children could enjoy the freedom to pursue their passions.

"My hope for my children is that they actually go into a field they want to, not just to provide for themselves and their family, but that they have a little bit of fulfillment and enjoyment in their day to day work, as well," said Stark.

IDeal is a state-run 529 college savings plan that families can use to save for the cost of college, starting as early as the birth of one's child. Money invested in a 529 account has the potential to grow and compound, and Idaho taxpayers who contribute to the account can take a tax deduction for their contributions.1 Beneficiaries can use money at any accredited postsecondary institution nationwide, and money used on qualified education expenses comes out of the account tax free.2

While saving ahead for college is challenging at best for many families, Rob and Vicki saw IDeal as a way to make their hard-earned dollars go farther. “It was a no brainer to me, if you want to save money for your kid,” said Rob. “The money grows tax-free; they try to keep all the maintenance and administrative fees very low, and however much risk you feel like taking, the options are there.”

After over a decade of saving, it seems that Rob and Vicki’s children are living the dream that the Starks had envisioned when they opened their IDeal accounts.

Their oldest daughter, Jill, graduated from University of Washington last year with a degree in Sociology, and is interviewing for a job with Amazon. “They don’t even interview you without a college degree,” said Rob. Jackie, their second daughter, has attended Northern Arizona University. Their son, James, is a junior at Gonzaga University, studying mechanical engineering. And Eric, their youngest, is a sophomore studying biomedical engineering at University of Utah.

“A lot of my friends are worried about where the money is coming from. For me, there are things that are stressful but it’s not a constant weight on my mind,” says Eric, who will graduate with minimal debt from subsidized loans only, so interest will not begin to accumulate until he graduates. “My engineering degree will take five years to complete, so unsubsidized loans would be really stressful because I would know the interest was accumulating.”

In addition, Eric notes that freedom from the worries of financing his college expenses has allowed him to focus on school, and enable him to seek out employment that complements his educational goals instead of competing with them. “For the upcoming semester, I will have a paid internship. A lot of my friends are lifeguards at a pool; my roommate worked at KFC. The last time I did that was in high school. It helps me stay motivated to do a job that complements my school work.”

Even Vicki is enjoying the fruits of her sacrifice—with some money remaining in one daughter’s account, Vicki reassigned the account into her own name and is using the funds to go back to school.

The expectation of college attendance created by the fact of having a college savings account is what IDeal Executive Director Christine Stoll believes is so powerful about her program. “Having a college savings account like IDeal, no matter how much you’re able to contribute, fosters a college-going culture in the home. The data doesn’t lie—children who grow up with college savings accounts are much more likely to go to college, even if the money in the account doesn’t cover all of their expenses.”

-Rob Stark

1 Contributions to the IDeal - Idaho College Savings Program are deductible from Idaho state income tax, subject to recapture in certain circumstances, such as a non-qualified withdrawal or a rollover to another state's qualified tuition program in the year of the rollover and the prior tax year.

2 Earnings on non-qualified withdrawals are subject to federal income tax and may be subject to a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

Robin Kelley Rausch, of Boise is a mother of two children—ages seven and four--who tries to carry on the college-going culture from the one she grew up with to her own family now. A Buhl native, Rausch learned early in life about the value of higher education from her parents. “My parents would say, ‘Money comes and goes. Health can be unpredictable. But once you earn an education, that’s yours. Nobody can take your education away from you.’”

Robin Kelley Rausch, of Boise is a mother of two children—ages seven and four--who tries to carry on the college-going culture from the one she grew up with to her own family now. A Buhl native, Rausch learned early in life about the value of higher education from her parents. “My parents would say, ‘Money comes and goes. Health can be unpredictable. But once you earn an education, that’s yours. Nobody can take your education away from you.’”

After a road trip across the Pacific Northwest, during which Rausch and her parents visited nearly a dozen schools, Rausch chose to follow both of her siblings and attend the University of Idaho. “It was never a question of if you were going. It was a matter of where to go,” says Rausch.

Understanding the benefits of higher education, but knowing that finances can be a major barrier, Rausch’s parents committed to helping their children pay for college. “The rule in my family was, you would graduate high school, and then you could get a job and start paying rent, or go to college and you would be supported.”

Of course, financing college for three children was no easy task, even in those days, which is one reason Rausch is using Idaho’s IDeal 529 College Savings Program today to save for her own children. “My parents just had to make it work; and it wasn’t easy. Rausch and her sister both worked throughout the school year with paid internships.

Rausch has had IDeal accounts for both children since they were infants, and contributes to the account monthly with automatic deductions. “I knew about IDeal accounts before having children. I then used my investment advisor to learn more and research the varying options,” she says. The children’s grandparents also help contribute to the account, and the children even chip in sometimes. “Last year my kids each received $100 for Christmas from a grandparent, with no strings attached. They both chose to invest in their college savings accounts. Going to college is something that we talk about as a family and they clearly understand that value,” she says.

For Rausch, helping her children attend college is about giving them a future of choice and opportunity. “One of the reasons that my family wanted us to have an education was to allow us to spread our wings,” she notes. A fourth-generation fruit farmer, Rausch insists that for just about any life path, including (perhaps especially) agriculture, higher education is an advantage. “I sell fruit and it doesn’t sound that complicated. But to be able to bear the responsibility of running an agricultural business, you have to know your own strengthens and work with others that are different from you. So glean whatever learning you can from your family and expand your own potential through other educational forums. Why would anyone want to limit their own capabilities?”

Rausch also aims to instill an appreciation for higher education in the students she encounters as an adjunct instructor at College of Western Idaho. “I tell my students, education is about you and your own personal development. Your education is yours. This is something of your choosing, and what a great opportunity it is. It’s not just about just going to class. It’s about finding out who you are…including what friends you like to have, how to manage finances, and time allocation. It’s about being able to make your own choices.”

Education is individual empowerment for Rausch’s own children. “My son is four, and I told him, ‘You are so close to being able to read and write your own stories.’ He got so excited that he is now writing miscellaneous letters and numbers on a notepad and says that he is writing a book.”

For Rausch, this empowerment is the reason she keeps saving for her children. Of course, if her children earn enough scholarships to cover the cost of school, Rausch has a plan to continue on with her own education. “I’m hoping they get scholarships to cover their own school so I can use the remaining for my doctorate,” she says.

Rausch has some advice for parents who want to inspire their own children to go on to higher education: “I think the message needs to come from both parents and other family members. The message is a common foundation of the family culture. Beyond talking about it, both parents need to be on board with putting that money away now.”

-Robin Rausch