Important Legal Information

By clicking on one of the social media icons, you are leaving the IDeal website, maintained by Ascensus, and are being redirected to a social media site solely maintained by the State College Savings Program Board (“Board”). Ascensus Broker Dealer Services, LLC, the program manager for IDeal, does not monitor or endorse the Board's social media activities. All IDeal social media activities are the sole responsibility of the Board.

Mr. Thiros is a registered representative of Ascensus Broker Dealer Services LLC, 877-529-2980, 95 Wells Ave, Newton MA (member FINRA/SIPC) and is not employed by the State of Idaho.

For more information about IDeal - Idaho College Savings Program ("IDeal"), call 866-433-2533 click here to obtain a Disclosure Statement. The Disclosure Statement discusses investment objectives, risks, charges, expenses, and other important information. Because investing in IDeal is an important decision for you and your family, you should read and consider the Disclosure Statement carefully before investing.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

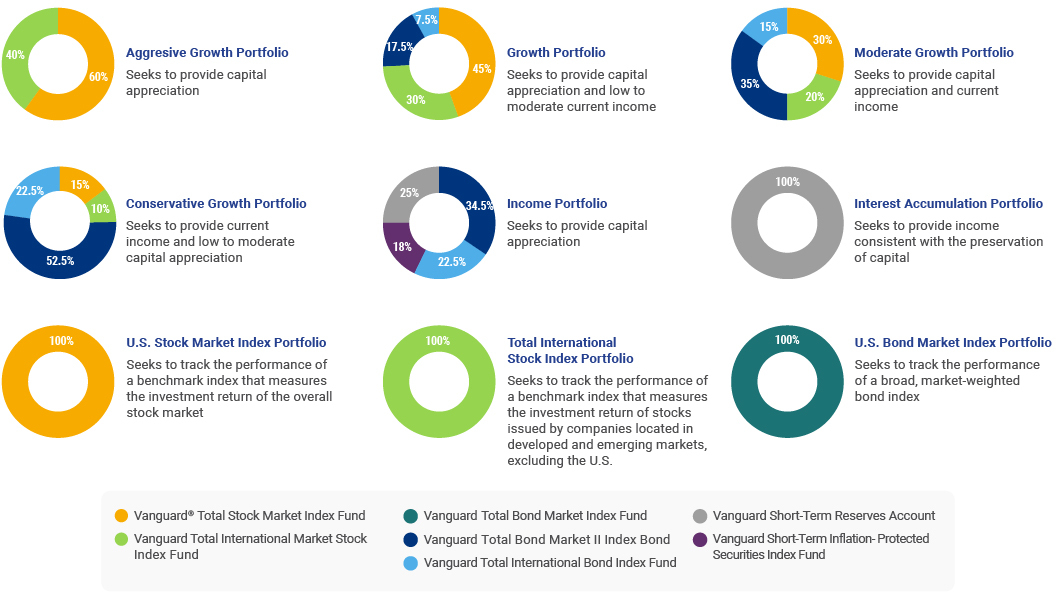

IDeal is administered by the State College Savings Program Board ("Board"). ABD, the program manager, and its affiliates, have overall responsibility for the day-to-day operations, including investment advisory, recordkeeping and administrative services, and marketing. The Vanguard Group, Inc. ("Vanguard") serves as Investment Manager for IDeal. Sallie Mae Bank serves as the Savings Portfolio Manager for IDeal. IDeal's Portfolios invest in either: (i) mutual funds and a separate account offered or managed by Vanguard; or (ii) an FDIC-insured omnibus savings account held in trust by the Board at Sallie Mae Bank. Except for the Savings Portfolio, investments in IDeal are not insured by the FDIC. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns will vary depending upon the performance of the Portfolios you choose. Except to the extent of FDIC insurance available for the Savings Portfolio, you could lose all or a portion of your money by investing in IDeal, depending on market conditions. Account Owners assume all investment risks as well as responsibility for any federal and state tax consequences.

Not FDIC-Insured (except for the Savings Portfolio). No Bank, State or Federal Guarantee. May lose value.